Total R899,00

Shop

“PAYE Registration” has been added to your basket. View basket

VAT Registrations

Timeframe: 14-21 days*

What Do I Need to Apply

Step 1

Accept Our Sales T&C

- Upfront Payment: Required before services commence.

- Invoice: Issued at payment, detailing services.

- Sales Terms: Outlined in the invoice.

- Funds: Ensure availability before ordering.

- Document Delivery: Sent via post or email after payment.

Step 2

Payment

Trusted Payment Gateway for secure online payments in South Africa

- Payfast: Secure payment gateway.

- Payment Methods: Immediately EFT, credit card.

- Manual Payment Method: FNB ATM cash deposit.

- Proof of Payment: Send to pop@uaesa.co.za.

Step 3

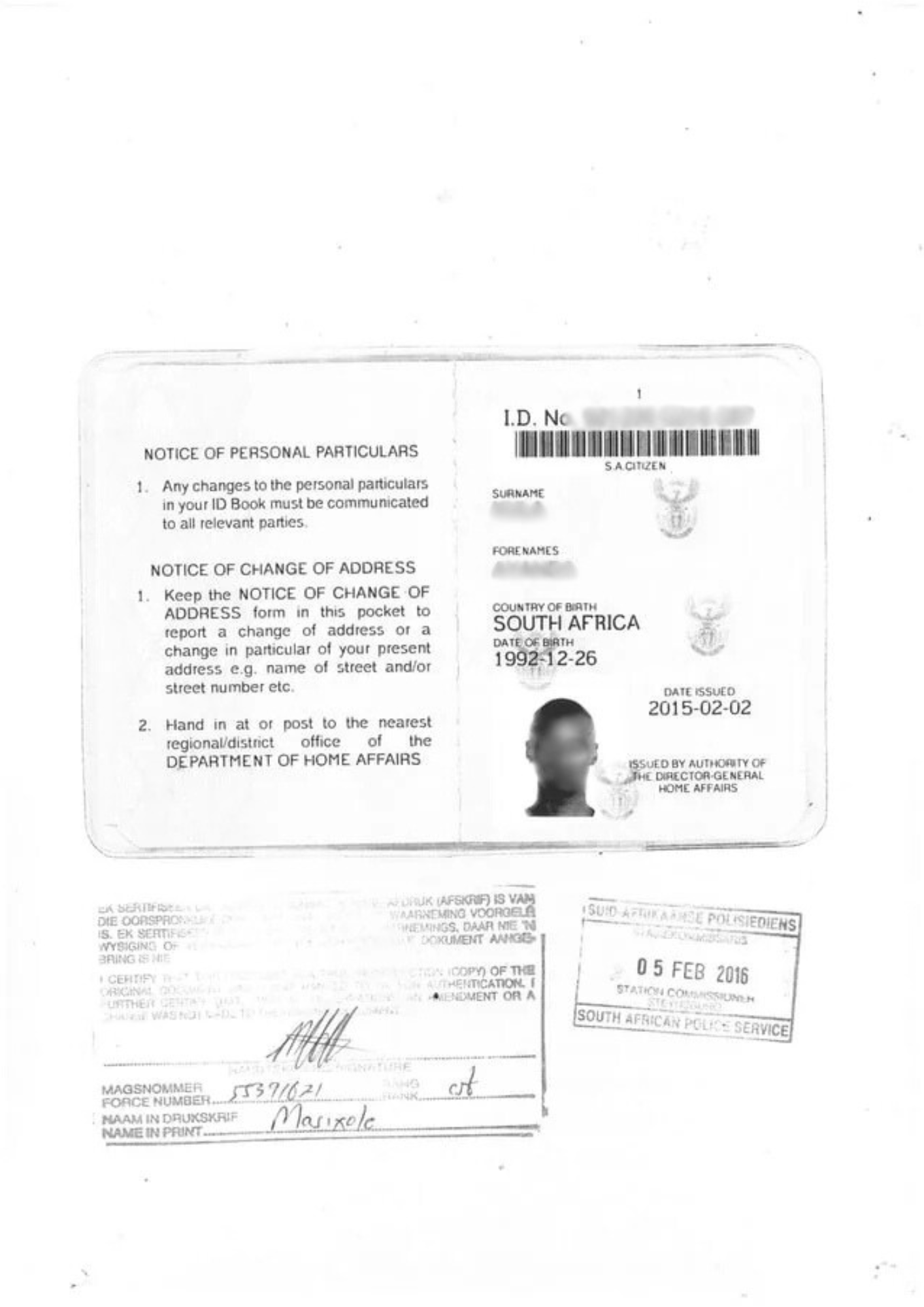

RSA ID / Passport

Identity documents are issued to South African or Valid Passport

- Only PDF Certified will be Accepted.

- Upload a PDF Certified copy of your ID/Passport docs.

- Photo captured with a phone camera will not be accepted.

- Asylum seeker not accepted.

- Expired passport will not be accepted.

- Passport will be Verified by CIPC – Foreigner Assurance

- all Manual Submission docs@uaesa.co.za.

Step 4

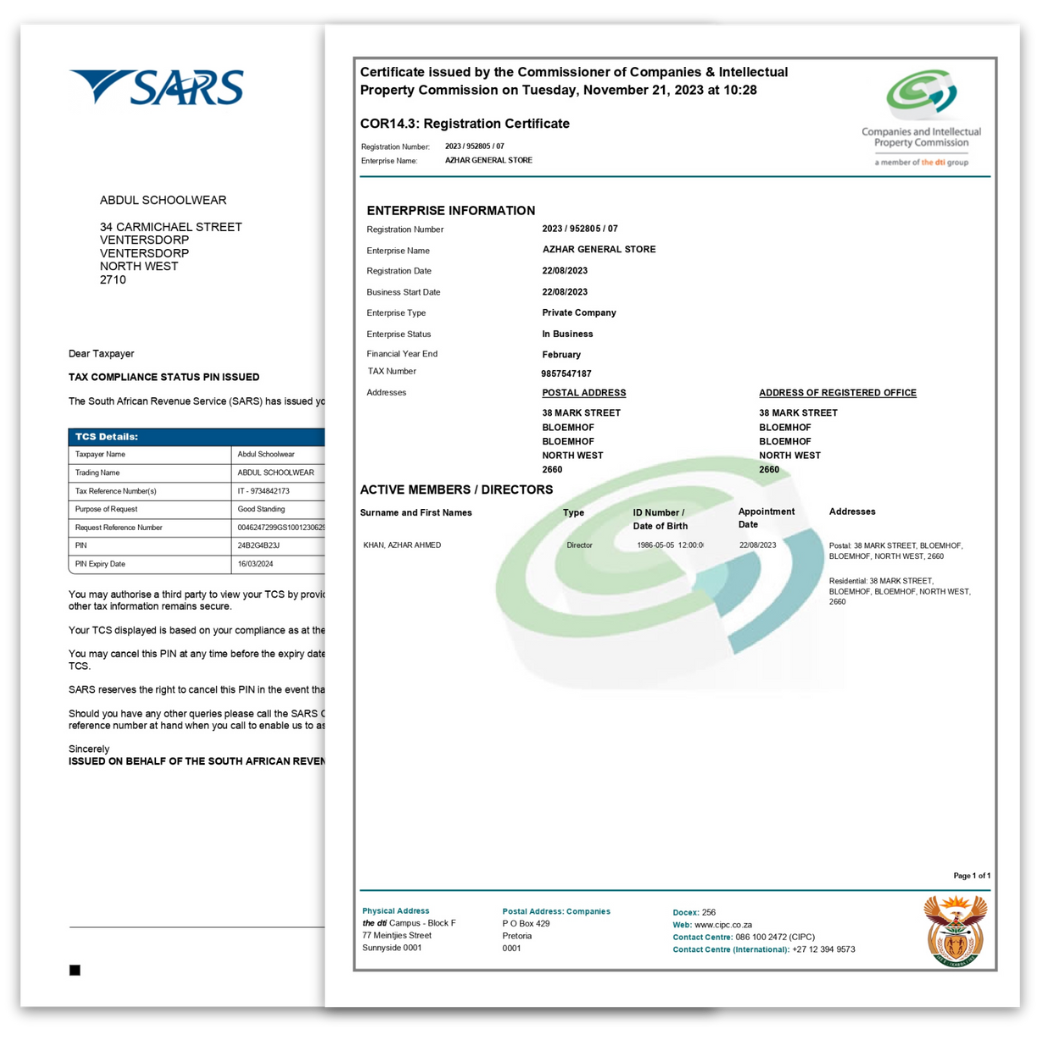

Requirements for VAT Registration in South Africa

To register for Value Added Tax (VAT) in South Africa, you will need the following:

- Signed power of attorney (will be provided).

- SARS Notice of Reg – Income Tax Number.

- Registration / disclosure certificate – COR14.3.

- SARS Registered Representative updated at SARS.

- Bank account confirmation letter.

- Director’s certified ID documents (not older than 3 months).

- Director’s proof of residence (not older than 3 months).

- Company proof of address (not older than 3 months).

- Customer invoices exceeding the amount of R50,000.00 (or R4200 pm for 2 months).

Important Notice:

South African Revenue Service (SARS) turnaround times vary depending on their workload. Consequently, we sometimes experience delays with the Registering a New Cross-Border Permits. Although the process has certainly become easier and shorter, Cross-Border Permits can take up to 1-3 Weeks.

Related products

Register a Holding Company

Timeframe: 1-3 Days

Rated 5.00 out of 5

2

1 review for VAT Registrations